JPMorgan Chase stated Friday that fourth-quarter revenue fell after paying a $2.9 billion payment associated to authorities seizures of failed regional banks final yr.

Right here's what the corporate reported versus what analysts surveyed by LSEG, previously often known as Refinitiv, anticipated:

- Earnings per share: $ 3.04, cannot evaluate with $ 3.32 anticipated.

- Income: $39.94 billion vs. $39.78 billion anticipated.

The financial institution stated quarterly earnings fell 15% to $9.31 billion, or $3.04 per share, from a yr earlier. Excluding the payment associated to the regional banking disaster and $743 million in funding losses, earnings had been $3.97 per share, in keeping with JPMorgan.

Income climbed 12% to $39.94 billion, beating analysts' expectations.

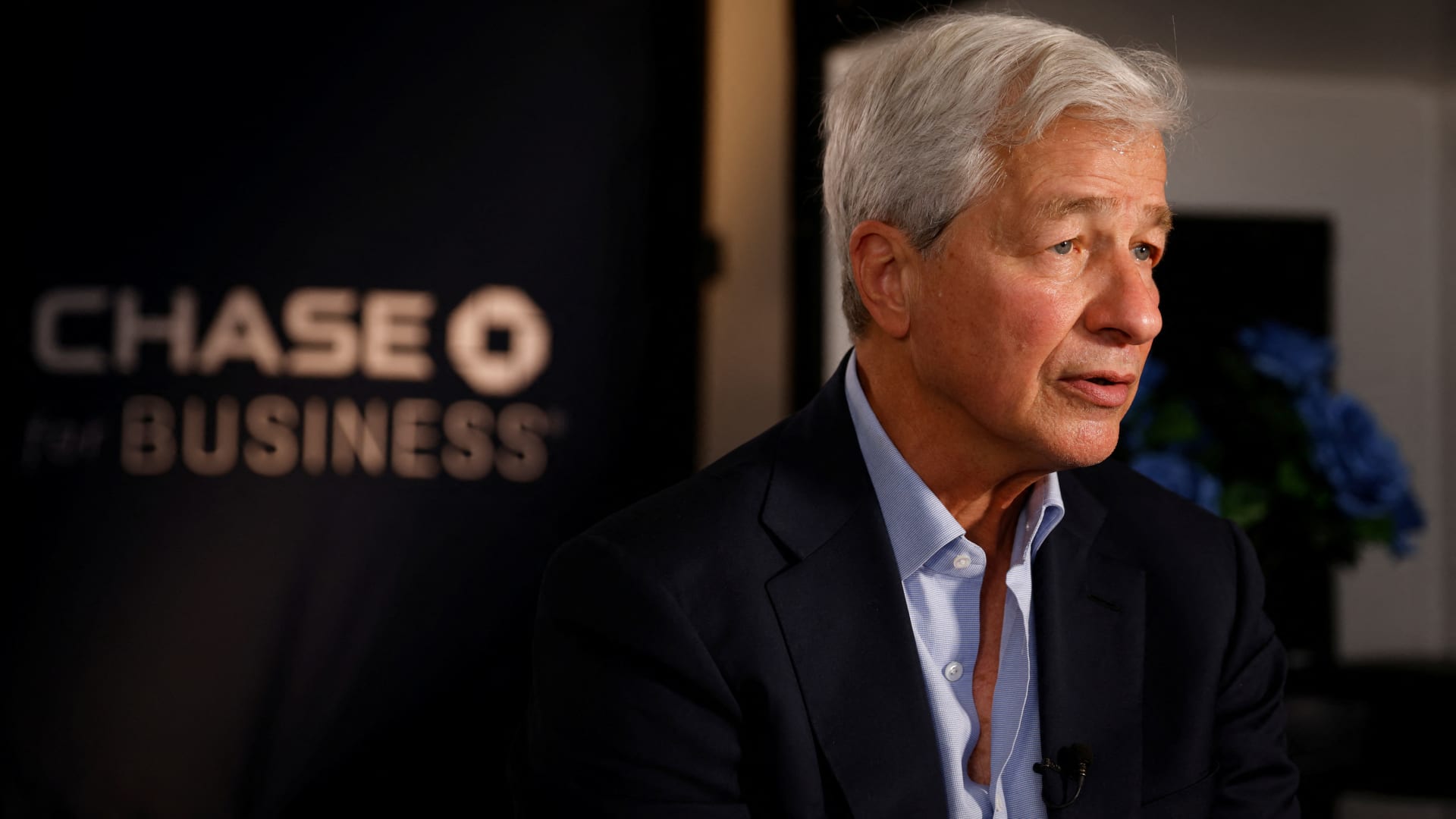

JPMorgan CEO Jamie Dimon stated full-year outcomes broke a document as the most important U.S. financial institution by belongings did higher than anticipated on internet revenue. curiosity and credit score high quality. The financial institution stated it would generate nearly $50 billion in revenue in 2023, $4.1 billion of which is able to come from the First Republic.

As through the 2008 monetary disaster, JPMorgan emerged larger and extra worthwhile from final yr's regional banking chaos after buying First Republic, a mid-sized lender for rich coastal households. The Federal Deposit Insurance coverage Company hit huge US banks with a particular evaluation to offset losses from a fund that helped uninsured depositors of foreclosed regional banks.

JPMorgan shares rose 1.9% throughout premarket buying and selling.

Regardless of his financial institution's efficiency, Dimon struck a cautious be aware concerning the American economic system.

“The US economic system continues to be resilient, with customers nonetheless spending, and markets presently count on a delicate touchdown,” Dimon stated within the launch.

However deficit spending and provide chain changes “may drive inflation to be stickier and charges to be larger than markets count on,” he stated. Dangers for markets and economies embody steps by central banks to strengthen assist packages and wars in Ukraine and the Center East, he added.

“These important and considerably unprecedented forces lead us to stay cautious,” he stated.

Whereas the financial institution has navigated the speed surroundings capably because the Federal Reserve started elevating charges in early 2022, smaller friends have seen their earnings tighten.

The business has been pressured to pay for deposits as prospects swap cash into higher-yielding devices, squeezing margins. On the similar time, rising yields imply that bonds owned by banks have fallen in worth, creating unrealized losses that put stress on capital ranges.

Concern can be rising over the rising losses from industrial loans, particularly workplace constructing debt, and better defaults on bank cards.

Past steering on internet curiosity revenue and mortgage losses for this yr, analysts need to hear what Dimon has to say about banks' efforts to ease upcoming will increase in lending necessities. capital.

Battered financial institution shares rallied in November on expectations that the Fed has managed inflation effectively and will lower charges this yr.

JPMorgan shares jumped 27% final yr, the most effective exhibiting amongst huge financial institution friends and outpacing the 5% decline within the KBW Financial institution Index.

This story is unfolding. Please verify again for updates.

Don't miss these tales from CNBC PRO: