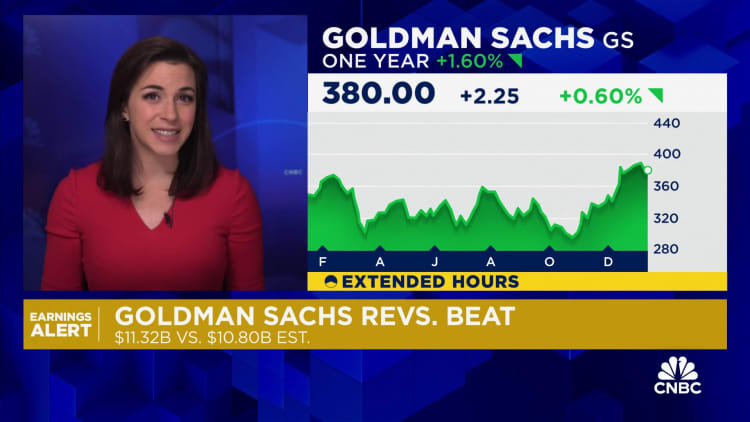

Goldman Sachs On Tuesday it launched fourth-quarter outcomes that beat analysts' expectations on better-than-expected wealth administration and wealth administration revenues.

Right here's what the corporate stated versus what Wall Avenue analysts polled by LSEG, previously referred to as Refinitiv, have been anticipating:

- Earnings: $5.48 per share; it was not instantly clear if that was similar to the $3.51 estimate of analysts surveyed by LSEG.

- Income: $11.32 billion vs. $10.8 billion anticipated, in accordance with LSEG

Goldman stated earnings for the quarter jumped 51% to $2.01 billion, or $5.48 a share, from a 12 months in the past, when the financial institution was weighed down by mortgage loss provisions and rising bills. The agency's income rose 7% to $11.32 billion on progress from the asset and wealth administration and platform options divisions.

Goldman CEO David Solomon has endured a troublesome 12 months, because of sluggish capital markets and strategic strikes. However hopes have been constructing that Goldman can flip a nook after transferring away from Solomon's failed banking efforts. The expansion engine for the financial institution, in accordance with Salomon, is now its asset and wealth administration division, which is benefiting from the rise in non-public credit score and different different property.

“With the whole lot we achieved in 2023 coupled with our clear and streamlined technique, we’ve a a lot stronger platform for 2024,” Solomon stated within the earnings launch.

Asset and wealth administration income jumped 23% from a 12 months earlier to $4.39 billion, beating StreetAccount's estimate by almost $550 million, on increased income from fairness investments and debt and rising administration charges. Helped by rising markets within the fourth quarter, Goldman stated it seen features on public shares and markups on debt investments.

Different Goldman divisions met or barely missed expectations. For instance, whereas platform options income jumped 12% to $577 million, this was beneath the estimate of $612 million.

Within the enterprise division of the corporate, the stronger than anticipated leads to shares largely offset a miss in fastened earnings.

Fairness buying and selling income jumped 26% to $2.61 billion, because of derivatives exercise and financing charges, beating the $2.22 billion StreetAccount estimate. Fastened earnings posted $2.03 billion in income, down 24% from a 12 months earlier on weak spot in rates of interest and foreign money buying and selling, and properly beneath estimates of $2.53 billion.

Funding banking charges fell 12% to $1.65 billion, matching StreetAccount's estimate, because the business's decline in accomplished acquisitions continued on the finish of the 12 months previous

Goldman's core enterprise of funding banking and buying and selling didn’t rebound strongly within the fourth quarter, however analysts wish to hear about the opportunity of a restoration in 2024. The primary indicators are that the companies which have been ready on the sidelines to amass opponents or elevate funds. might lastly be able to act this 12 months.

In contrast to extra diversified rivals, Goldman will get most of its income from Wall Avenue. That may result in extreme returns throughout growth instances and underperformance when markets don't cooperate.

That was mirrored within the financial institution's return on tangible fairness, a key metric tracked by traders and analysts, which was solely 8.1% for 2023, properly beneath its medium-term aim of 15% to 17%.

The financial institution stated it lower jobs by 7% final 12 months, or 3,200 positions by the top of 2022, largely from a wave of layoffs in early 2023.

Goldman is Morgan Stanley, which additionally reported fourth quarter earnings on Tuesday, are the final of the most important US banks to launch outcomes for the interval. Friday, JPMorgan Chase, Financial institution of America, Citigroup and Wells Fargo every printed outcomes that have been spoiled by a litany of articles as soon as.

This story is unfolding. Please verify again for updates.