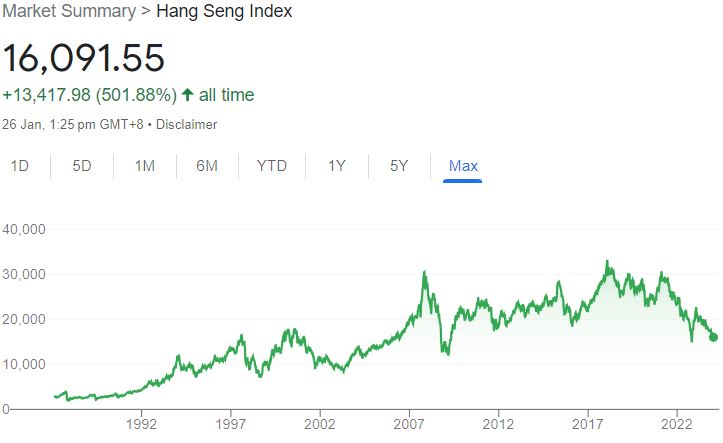

Taipei, Taiwan – Like many Hong Kongers, accountant Edelweiss Lam spent the previous week watching town's inventory market report 14 months of good points because the Cling Seng Index fell beneath the psychological threshold of 15,000 factors.

It was not the primary time that Lam, who has invested within the Hong Kong inventory market because the late Nineties, had seen this occur.

The index fell beneath 15,000 factors throughout SARS in 2003, the International Monetary Disaster in 2008, and the zero-COVID lockdowns in 2022.

However whereas ebbs and flows are a part of the funding sport, Lam stated watching the important thing measure of Hong Kong's inventory market fall “again to sq. one” felt totally different this time.

“It appears I can't see the long run,” Lam instructed Al Jazeera by telephone from Hong Kong.

The explanation, Lam stated, is China.

As Beijing will increase its management over all elements of life in Hong Kong, together with the financial system, and gloom persists over the state of China's post-pandemic restoration, buyers have voted with their cash. and seeking to different markets.

Greater than 1 / 4 of a century after Hong Kong's return to China, the Cling Seng is kind of again to the place it was in its final days as a British colony.

On Friday, the index was beneath 16,100 factors – decrease than it was on July 1, 1997, the day of the provider.

In the identical interval, shares in the USA, Japan and different well-liked markets have flourished.

Buyers within the SP500, the most well-liked measure of U.S. inventory market efficiency, have seen their cash develop almost 10-fold since 1997.

“If there’s a new announcement from the Chinese language authorities about laws or management of a sure trade, then the market can fluctuate very significantly,” stated Lam, whose funding portfolio consists of blue-chip shares, deposits at time period and possession.

“The connection between Hong Kong and China is getting nearer and nearer, the management is tighter, so we are able to't ignore what they’re doing in China.”

Hong Kong has had a front-row seat to China's crackdowns lately, from the imposition of a draconian nationwide safety regulation on town to tight regulation of company giants like Alibaba and Tencent and raids on international firms in mainland China.

Lots of China's largest firms are dual-listed in Hong Kong and China and make up a big a part of the Cling Seng Index together with Chinese language banks and different expertise firms.

On the identical time, China's financial system has struggled to recuperate from the impression of COVID-19 and Beijing's robust pandemic restrictions amid nagging structural issues, together with a shrinking inhabitants, excessive public debt native authorities, and a sluggish actual property disaster.

Gross home product formally grew by 5.2 % in 2023 — the weakest efficiency in a long time, excluding the pandemic.

Regardless of Beijing's insistence that China is open for enterprise, international investor confidence is on the decline.

Final 12 months, China recorded the primary drop in international direct funding in 12 years, with inflows down 8 % to $157.1 billion.

“After we take a look at broader enterprise sentiment for the monetary sector and the general financial system – initially, the financial fundamentals in each Hong Kong and China should not trying good in the intervening time,” Chim Lee, a China analyst at in 2018. Economist Intelligence Unit, instructed Al Jazeera.

Lee stated China's achievement of its financial progress goal final 12 months was “not significantly spectacular” as Beijing set a comparatively weak goal.

Analysts estimate that about $ 6 trillion – the equal of greater than 1 / 4 of the output of the US financial system – has been faraway from the inventory markets in China and Hong Kong because the starting of 2021.

China's CSI 300 index, which measures the highest 300 firms on the Shanghai and Shenzhen inventory exchanges, has fallen greater than 40 % up to now three years, whereas the Cling Seng has fallen 50 % in the identical interval, in accordance with Bloomberg knowledge.

Buyers are as an alternative flocking to different markets reminiscent of Japan and the USA the place analysts predict a bullish 2024.

The Nikkei 255 Index, an index of high firms on the Tokyo Inventory Change, posted highs not seen in additional than 30 years final week, whereas the S&P 500 in New York closed at an all-time excessive for the sixth day in a row Thursday.

“[Hong Kong’s] The financial system could also be not more than a big rounding error on China's GDP, however it nonetheless performs an necessary function in monetary and capital market transactions for and with the Mainland. Due to this fact, it’s evident that the bearish sentiment and valuations of China's battered inventory costs are sporting off. [Hong Kong] too,” George Magnus, an affiliate on the College of Oxford's China Heart and Analysis Affiliate at SOAS, London, instructed Al Jazeera.

Hong Kong's dwindling rights and freedoms – that are alleged to be assured till 2047 beneath an settlement often known as “one nation, two programs” – have added gasoline to the disaster of confidence.

For the reason that passage of the nationwide safety regulation in 2020, town's political opposition and impartial media have been largely suppressed and tons of of individuals have been arrested for non-violent offenses associated to activism and speech.

Tons of of 1000’s of Hong Kongers have left town amid Beijing's tight management over their cash.

Lam stated he determined final 12 months to maneuver his pension fund abroad and plans to promote his remaining Hong Kong inventory investments at a loss.

“They are saying they wish to do one thing, however we don't see any actual motion,” Lam stated of the federal government's financial coverage.

In October, Hong Kong lowered stamp responsibility on property gross sales and inventory transfers, however consumption and tourism have but to recuperate to pre-pandemic ranges.

Analysts say that reviving the financial system of Hong Kong and China will take a lot bolder motion.

Beijing is contemplating a possible $278 billion bailout plan for the inventory market, Bloomberg reported this week, citing sources near the matter, however many analysts argue that broader structural reforms are wanted to revive investor confidence.

The same rescue plan carried out after a crash in China's inventory market in 2015 produced combined outcomes – though the federal government moved shortly and the general financial system was stronger.

Recollections of that bailout and issues that Beijing won’t make troublesome however essential reforms are one purpose the bailout has been met with a tepid response, stated Alicia Garcia Herrero, chief Asia economist. Pacific in Natixis.

“That is actually the market that claims, I'm sorry that you’re not rising. I don’t belief your numbers; your future seems to be gloomy – which was not the case in 2015. It was perceived to be a brief shock , so I believe that is, to start with, the distinction,” Garcia Herrero instructed Al Jazeera.

Beijing arguably has even much less room for maneuver this time round due to its excessive debt ranges and the restricted scope of financial easing.

“They used so many bullets, the credibility of the following bullet is decrease,” he stated.