Merchants work on the ground of the New York Inventory Trade (NYSE) in New York Metropolis, United States, on January 19, 2024.

Brendan McDermid | Reuters

Markets have develop into much less satisfied that the Federal Reserve is able to press the button on rate of interest cuts, a problem that cuts to the guts of the place the financial system and shares are headed.

Two main financial studies coming this week might go an extended technique to decide at the least which approach the central financial institution's decision-makers may lean – and the way the markets may react to a shift in financial coverage.

Buyers will get their first have a look at the broad image of financial progress for the fourth quarter by means of 2023 when the Commerce Division releases its preliminary estimate of gross home product on Thursday. Economists surveyed by Dow Jones count on the overall of all items and providers produced within the US financial system to develop at a price of 1.7% for the final three months of 2023, which might be the slowest progress for the reason that lower of 0.6% in Q2 of 2022.

A day later, the Division of Commerce will launch the December studying on the worth index of private consumption bills, an inflation indicator most well-liked by the Fed. The consensus expectation for core PCE costs, which exclude risky meals and vitality elements, is 0.2% progress for the month and three% for the total yr.

Each information factors ought to obtain loads of consideration, particularly the inflation numbers, which have been trending towards the Fed's 2% goal, however will not be there but.

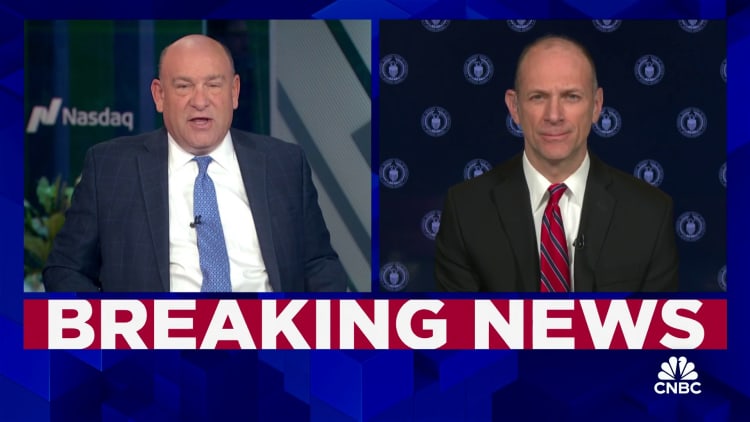

“That's what everybody must be watching to find out what the Fed's price path will probably be,” Chicago Fed President Austan Goolsbee stated throughout an interview on Friday with CNBC. “It isn’t about secret conferences or choices. It’s basically in regards to the information and what is going to permit us to develop into much less restrictive if now we have clear proof that we’re on the way in which to return” inflation to the goal.

Prospect of tax cuts

The releases come amid a market snapback about the place the Fed is headed.

As of Friday afternoon, buying and selling within the fed funds futures market equates to virtually no probability that the Federal Open Market Committee will minimize charges at its January 30-31 assembly, based on the CME Group information as indicated by means of its FedWatch Software. It's nothing new, however the chance of a minimize within the March assembly fell to 47.2%, down sharply from 81% only a week in the past.

Together with this, merchants took an anticipated minimize off the desk, lowering the prospect of easing to 5 quarters of proportion factors down from six beforehand.

The change in sentiment adopted information exhibiting a stronger-than-expected 0.6% rise in shopper spending for December and preliminary jobless claims falling to their lowest weekly stage since September 2022. As well as, a number of of Goolsbee's colleagues, together with Governor Christopher Waller, New York Fed President John Williams, and Atlanta Fed President Raphael Bostic, have issued feedback indicating that at the least they aren’t in a rush to chop even when the heights are in all probability completed.

“I don't prefer to tie my arms, and we nonetheless have weeks of knowledge,” Goolsbee stated. “We take the lengthy view. If we proceed to make stunning progress quicker than anticipated on inflation, then we’ll take this into consideration in figuring out the extent of restrictiveness.”

Goolsbee famous {that a} explicit space of focus for him will probably be housing inflation.

The December shopper value index report confirmed that headline inflation, which accounts for a couple of third of the weighting within the CPI, rose 6.2% from a yr in the past, properly forward of a tempo in line with inflation of two%.

Nonetheless, different measures inform a unique story.

A brand new studying from the Division of Labor referred to as the New Tenant Lease Index, tells a unique story. The index, which measures costs for brand new leases signed by tenants, confirmed a 4.6% drop within the fourth quarter of 2023 from a yr in the past and greater than doubled quarterly.

Trying on the information, and different components

“Within the very close to time period, we predict inflation information will cooperate with the Fed's dovish plans,” Citigroup economist Andrew Hollenhorst stated in a shopper notice.

Nonetheless, Citi sees inflation as cussed and more likely to delay the primary minimize till at the least June.

Whereas it isn’t clear how a lot of a distinction the timing makes, or how vital it’s if the Fed solely cuts 4 or 5 instances in comparison with the extra formidable market expectations, the market outcomes appear to be associated to the expectations of the financial coverage.

There are various components that change the outlook in each instructions – a continued rally within the inventory market might fear the Fed about extra inflation within the pipeline, as might an acceleration of geopolitical tensions and stronger than anticipated financial progress .

“Protecting the potential for inflation alive, these financial and geopolitical developments might put upward strain on short-term charges and long-term yields,” Komal Sri-Kumar, president of Sri-Kumar World Methods, he stated on Saturday. its weekly market notice.

“May the Federal Reserve be pressured to boost the Federal Funds price as its subsequent transfer as an alternative of reducing it?” he added. “An intriguing thought. Don't be stunned if there’s extra dialogue alongside these traces within the coming months.”