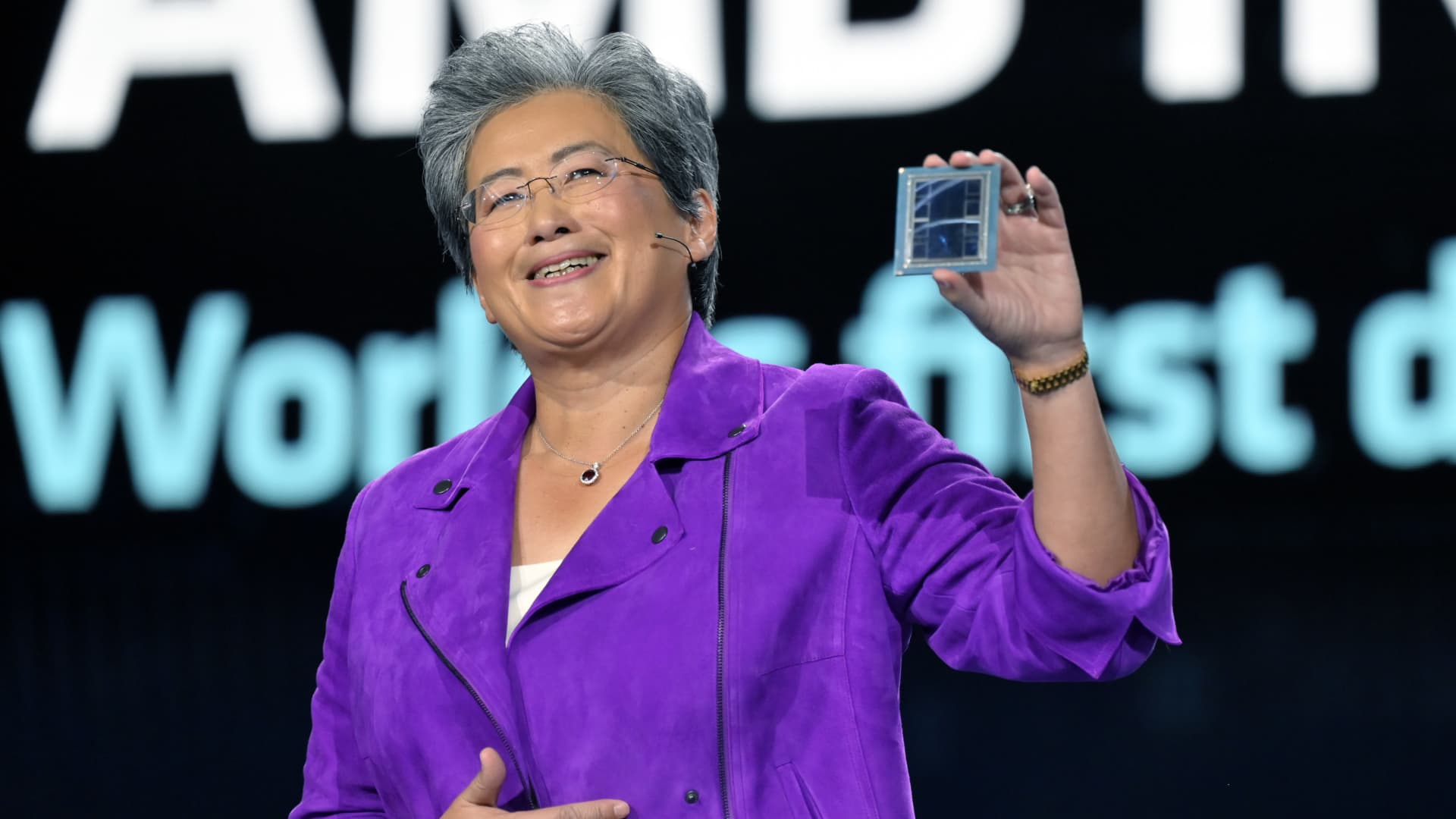

Lisa Su exhibits off an AMD Intuition MI300 chip whereas giving a keynote speech at CES 2023 in Las Vegas, Nevada, on January 4, 2023.

David Becker | Getty Photos

AMD Shares rose greater than 8% on Tuesday to their highest closing worth since hitting a file excessive in November 2021, on optimism that the corporate's synthetic intelligence chips will probably be in higher demand from firms akin to Microsoft, Google and OpenAI.

Tom O'Malley, an analyst at Barclays, raised his worth goal on AMD to $200 from $120, saying AMD may publish $4 billion in AI chip gross sales this yr. O'Malley, who has the equal of a purchase score on the inventory, cited robust demand for the MI300, AMD's prime machine studying chip for servers.

KeyBanc analysts additionally raised their worth goal for AMD to $195 and Nvidia to $740 on Tuesday, on account of robust demand for AI servers.

AMD closed at $158.74 on Tuesday, about 2% beneath the inventory's excessive. Nvidiawhich has the biggest market share for AI chips and was the best-performing inventory within the S&P 500 final yr, superior 3% to $563.82.

On the finish of 2023, AMD introduced new AI server chips to compete with Nvidia's H100 and A100 GPUs, that are utilized by OpenAI to coach and serve its fashions just like the one on the coronary heart of ChatGPT.

AMD and Nvidia are the 2 main producers of graphics processing items, which have been invented for superior pc video games, however at the moment are vital for coaching and operating AI fashions. Since AI purposes have gained the eye of traders prior to now two years, Nvidia has been the first beneficiary as a result of the corporate developed AI software program for its chips greater than 10 years in the past.

“They've constructed a layer of software program round their chip that the businesses I spend money on can't get sufficient of,” enterprise capitalist Jim Breyer advised CNBC on Tuesday.

Breyer mentioned he was “beating the desk” for each Nvidia and AMD shares.

Analysts see AMD bettering its AI software program and count on main chip consumers akin to cloud suppliers and tech giants to be cautious of utilizing AMD GPUs.

“We’re under no circumstances discounting the pinnacle begin NVDA has, however we predict the need to have a second supply will outweigh the difficulties for the software program ecosystem,” O'Malley wrote.

WATCH: I added AMD to the “Magnificent Seven”

Don't miss these tales from CNBC PRO: